reit dividend tax malaysia

Listed REITs in Malaysia are exempted from annual tax assessment if they distribute 90 of the years total income to unitholders. Here we have highlighted the Top 10 REITs in Malaysia by market cap.

Pdf The Performance Of Real Estate Investment Trusts In Malaysia Semantic Scholar

If a Real Estate Investment Trusts fund distributed at least 90 percent of their total yearly income to unit holders the REIT itself is exempted from tax for that year of assessment.

. VERO BEACH Florida April 26 2022 GLOBE NEWSWIRE -- ARMOUR Residential REIT Inc. VERO BEACH Florida April 26 2022 GLOBE NEWSWIRE -- ARMOUR Residential REIT Inc. IFAST Research Team11 Jun 2021 What are REITs.

One huge tax benefit of a REIT is that most income earned by it is exempted from income tax. Continue reading Top 10 REITs in Malaysia. REIT dividend will be taxed in their tax computation.

General company tax of 25 is applicable. Dividends received by REITs are taxable as ordinary income up to a maximum rate of 37 returning to 390. Capitaland Retail China Trust Earnings Report.

ARREIT has gearing of 4365 and involved in office building educational industrial hotels and. In Malaysia REITs are only allowed to borrow up to 50 of their total assets the limit has been temporarily increased to 60 until the end of 2022. The REIT generates 2 per unit from operations and distributes 90 or 180 to unitholders.

A REIT needs to pay tax on any taxable income earned during the year at a rate of 24 unless it distributes at least 90 of its total income to the unit holders during the year. The remaining 060 comes from depreciation and. 19 rows Name Fullname Code Price PE ROE Payout ratio Gearing Ratio TTM DY Yield Link.

6 in 2026 plus a separate 3 plus a separate 3 plus a. The first real estate investment trust REIT established in. A Real Estate Investment Trust REIT is a fund or.

The Malaysian REIT sector as represented by the Bursa REIT Index is dominated by household names in Malaysia such as KLCC Sunway and Pavilion. In a case where dividend income forms part of the total income distributed to unit holders the tax credit from tax at source is given to the REITPTF and the tax computation at REITPTF and. The first real estate investment trust was established in the United States in 1960 providing investors with the chance to participate in massive real estate holdings.

Of this 120 of the dividend comes from earnings. ARR and ARR-PRC ARMOUR or the Company today announced the May 2022 cash dividend for the. Taxation and tax exemption of REITs in Malaysia.

May 2022 Common Stock Dividend Information Month Dividend Holder of Record Date Payment DateMay 2022 010 May 16. This allows the REIT to distribute its income on a gross basis. REITs in Malaysia and around the world benefit from favorable tax treatment and typically give larger dividend yields than other corporations.

REITPTF level-subject to tax 2000-not subject to tax REITPTF 10000 -not subject to tax REITPTF 14000 Distribution from REITPTF Distribution from REITPTF Year 2 RM Year 1 RM 3. REITs in Malaysia are exempted from the 25 income tax if they distribute at least 90 of their current year taxable income. No withholding tax is charged on retail investors.

Withholding tax of 10 or 25. As long as REITs in Malaysia distributes at least 90 of its current year taxable income the REIT will not be levied the a 25 income tax. The government currently imposes a 10 withholding tax on REIT dividends to local and non-resident individual investors.

On the contrary there is withholding tax for dividend payouts from REITs in the US 30 UK 20 and Japan 15. This means that the dividends payouts are taxed with its respective rates before it reaches the investors. Gearing is the highest as well at 442.

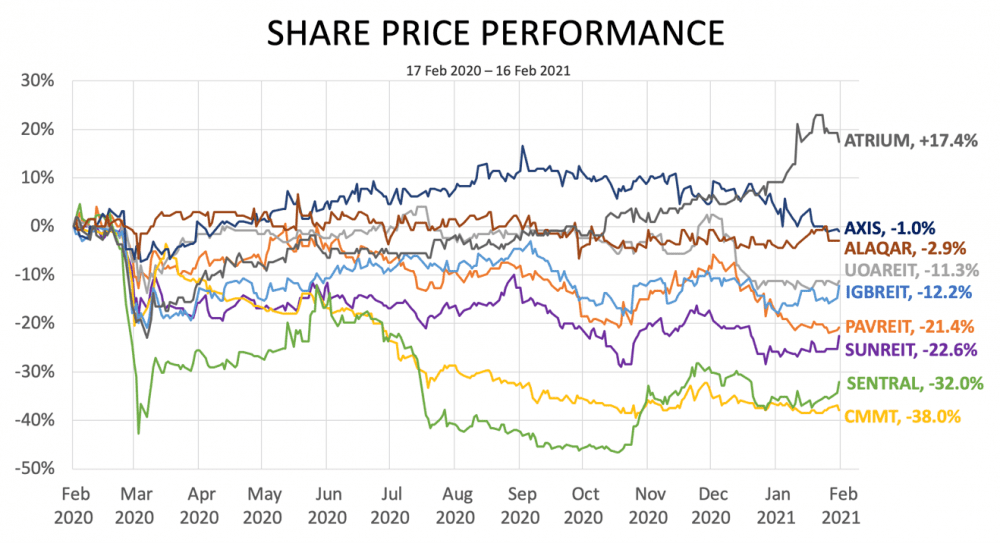

893 Since 2010 every RM1000 investment in ALAQAR REIT wouldve turned into RM1600. It has strong cornerstone investor which is Frasers Centrepoint Trust listed in Singapore. Taxation of dividend income distributed by REIT in the hand of investors.

Pavilion REIT Annualised return. We prefer REITs with a gearing ratio of less than 40 because it allows the REIT to have a buffer for more loans in case it needs to borrow to make an acquisition. ARR and ARR-PRC ARMOUR or the Company today announced the May 2022 cash dividend for the Companys Common Stock.

Sunway REIT Annualised return. Including dividends every RM1000 would cumulatively become RM2560. However unit holders are liable to tax on the distribution of income.

Hektar is the first retail focused reit in Malaysia. Since the income distributed by REITs are tax exempt no tax credit under subsection 110 9A of the Income Tax Act ITA 1967. With this tax system most Malaysian REITs if not all always distributes at least 90 of its.

21 rows AmFirst REIT. 1068 Since 2011 every RM1000 investment in PAVREIT wouldve turned into RM1550. REIT dividends received after 31 Dec 2011 will be taxed at original 20 for foreign institutional investors and 15 for non-corporate.

The reduced withholding tax of 10 on individual and non-corporate investors is only available up to 31 Dec 2011.

Axis Reit Archives Dividend Magic

Ms Word Securities Commission Of Malaysia

Reit Regulatory Structure And Characteristics For Nigeria And Malaysia Download Table

Multi Management Future Solutions Malaysia Tax On Reit Investment Malaysia Starting For The Year 2009 Tax For Reit Dividend Is As Follows Also Grab The Opportunity Of Free Analysis Report

Summary Of Reits Stock Quote And Listed On Main Board Of Bursa Malaysia Download Table

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

Pdf Malaysian Real Estate Investment Trusts M Reits A Performance And Comparative Analysis Semantic Scholar

A Complete Guide To Reits Malaysia Real Estate Investment Trusts Youtube

Pdf The Performance Of Real Estate Investment Trusts In Malaysia Semantic Scholar

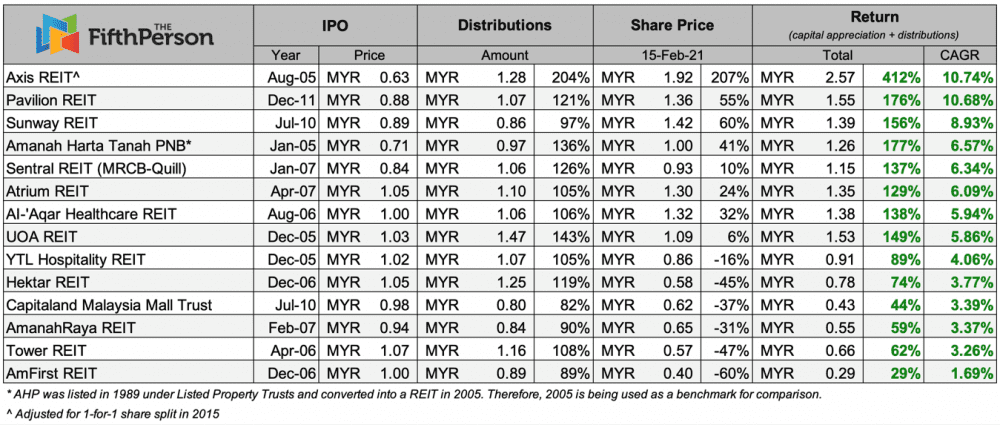

Top 5 Malaysia Reits That Made You Money If You Invested From Their Ipos Updated 2021

Reits Listed On Bursa Malaysia As At March 2016 Download Scientific Diagram

Finance Malaysia Blogspot Understanding Reits

Dairy Producer Farm Fresh Surges In Kuala Lumpur Trading Debut

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

How Are Individual Reit Holders Taxed

Summary Of Reits Stock Quote And Listed On Main Board Of Bursa Malaysia Download Table

The Complete Guide To Reits In Malaysia Dividend Magic Malaysia Tourist Places Tourist Places Places To Visit

Nav And Dpu Of Ireits In Malaysia Download Scientific Diagram